Hire Purchase Car Finance

Everything you need to know about hire purchase (HP) agreements, including how they work, their benefits, risks, and key differences between hire purchase and other financing options.

How Does HP Work?🤔

Hire purchase (HP) is a type of car financing that allows you to spread the cost of your new car over a set period of time, usually between one and five years. It’s a popular choice for those looking to buy a new or used car.

Once you've finished all your payments, the car is officially yours. You can sell it, keep it, or even use it to get another loan! We'll also send you a "statement of title" which proves you're the car's legal owner. HP car finance is a great option for those who want to get behind the wheel sooner without breaking the bank.

-1.png?width=360&name=Thinking%20(2)-1.png)

Benefits And Risks Of HP Finance⚖️

- Affordable way to finance a car.

- Flexible repayment options that can be tailored to your budget and needs.

- Low initial deposit can help make the car more accessible.

- Fixed interest rates provide stability and predictability for budgeting.

- Ownership of the car at the end of the agreement.

- No mileage or usage restrictions as you own the car during the agreement.

- Can help build credit history and improve credit score through regular repayments.

- No large balloon payment at the end of your agreement, as there would be with a PCP agreement.

- If you miss payments, your credit score can be negatively affected, and the car can be repossessed.

- You’re tied to the car for the duration of the agreement and may have to pay early settlement fees if you want to end it early.

- You don’t own the car until you’ve made all the repayments, so you’re unable to sell the vehicle until you’ve paid off your agreement.

- Not suitable for short-term car ownership or if you plan to change your car frequently.

.jpg?width=360&name=HP%20Hero%20Image%20Option%20(2).jpg) A happy woman at a car dealership showing her car keys to the camera with a red convertible in the background." width="1920" height="1080" />

A happy woman at a car dealership showing her car keys to the camera with a red convertible in the background." width="1920" height="1080" />

The Importance of Deposits In Hire Purchase Agreements🔍

In Hire Purchase agreements, the deposit you pay upfront is important. The larger the deposit, the lower your monthly payments will be, as it reduces the amount that you need to borrow. Having a larger deposit can also help you secure a better interest rate.

Looking for car finance but don't have money for a deposit? Visit our No Deposit Car Finance page.

Compare Your Car Finance Options

The Differences Between HP And PCP🚘

Hire Purchase

Personal Contract Purchase

Car Ownership At The End Of Your Agreement

Fixed Monthly Payments

Final Balloon Payment

Avoid Excess Mileage Charge

Secured Against An Asset (e.g. a car)

Support With Vehicle Issues

Requires Initial Deposit

Car Finance Your Way

Unsure Which Car Finance Option Is Right For You?🤷

Get HP Car Finance Today

Apply below

Explore PCP (Personal Contract Purchase)

Find out more

Ready To Apply For Hire Purchase Car Finance?🚀

We've helped thousands of customers get behind the wheel of their dream car. Apply for car finance today in just 30 seconds and find out if you're pre-approved* without impacting your credit score.

Reviews From Our Trusted Customers🌟

Uncover real experiences from Marsh Finance customers and discover why they trust us. Dive deeper into reviews on Trustpilot!

“I spoke to Jen yesterday and I couldn’t be more grateful for the amount of support I received during the call. She was so lovely, made me feel reassured and did all she could to help. By far the best customer service I have personally ever received. Thanks again, Jen”

Trustpilot View

“Yasmeen is an absolute asset to your company! Took the time to understand my circumstances and the help offered was second to none! Thank you!!”

Trustpilot Review

“Great customer service from Marsh Finance. Very helpful service while I have been changing jobs and getting my payment dates on track. 1st class service. Thanks once again Marsh Finance 👍”

Trustpilot Review

“Hi Id like to say a big big thank you to Sarah at Marsh Finance if could put 10 stars I would sorted my problem out so quickly and easily big thanks to Sarah at Marsh Finance thank you”

Trustpilot Review

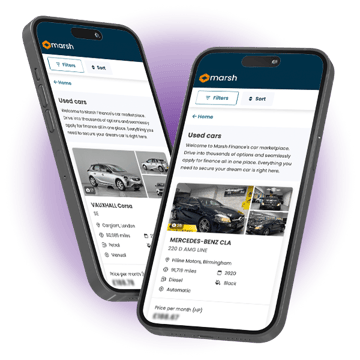

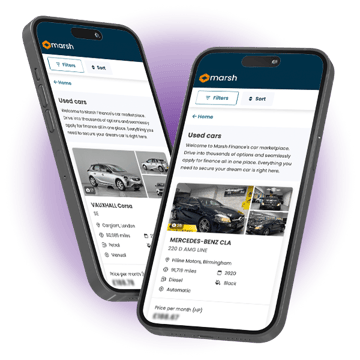

Looking For A New Car? Visit Our Exclusive Car Marketplace

👉 Thousands of cars at your fingertips

🎯 Over 24 filters to pinpoint your perfect car

💰 Organise by finance cost & search radius

🚘 Easily apply for car finance on your chosen model

Click Here To Find Your Dream Car 🚀

Hire Purchase (HP) Car Finance FAQs

Am I eligible for HP car finance?

We want to help you get behind the wheel! Here's a quick rundown of our Hire Purchase eligibility:

- Minimum age: Generally, you need to be 22 or older. In some cases, exceptions might be made for those with a mortgage or a proven track record of loan repayment (e. g., previous HP agreement).

- Basic requirements: We'll need to verify some info to process your application, such as your address, income, employment details, and a valid driver's license.

- Credit score considerations: While good credit helps, we understand situations aren't always perfect. We can still help you explore options!

Here are some additional points to consider:

- The car also matters: We have criteria for the car itself, such as age, mileage, price, and condition.

- Fast and easy application: Apply online in 30 seconds and get a decision the same day, with no impact on your credit score yet.

Ready to see if HP finance is right for you? Apply for car finance with Marsh Finance today, and let us help you hit the road!

Do I need a good credit score to apply for car finance?

Not necessarily! While having a good credit score can certainly make it easier to get approved for car finance, there are lenders out there who are willing to work with borrowers who have a poor credit history. Even if your credit score isn’t great, you still have options available to you. With a little bit of effort, you could be driving away in your new car in no time!

It only takes 30 seconds to submit a car finance application with Marsh Finance, you’ll find out if you're pre-approved on the same day without impacting your credit score.

Does applying for car finance affect my credit score?

The good news is that when you apply for car finance with Marsh Finance, it won’t have an impact on your credit score. We only conduct a ‘soft credit check’ when you apply, which won’t be visible to other lenders. This means that your credit score won’t be affected by the application process.

The application itself is super quick, taking only 30 seconds to complete. And the best part? You’ll find out if you’re pre-approved on the same day! Apply now.

It’s important to note that we will conduct a ‘hard credit search’ when you sign the contract and finance agreement. This will show as a hard search on your credit report, but we’ll be sure to let you know beforehand.

How do I make a car finance application?

Applying for HP car finance is easy! Here are your options:

- Apply online : Fill out our quick and secure application form right here on our website. It only takes about 30 seconds!

- Talk to us: Our friendly team is happy to answer your questions and guide you through the application process.

- Email us at directsales@marshfinance. co. uk

- Call us on 01706 648882

We want to get you on the road to your new car quickly and easily!

How long does it take to get approved?

We strive to get you approved quickly! Here's a breakdown:

- Fast check: Our automated systems can give you an initial decision within minutes without hurting your credit score.

- Extra info needed? Sometimes we might need a little more information to finalise your agreement.

- Approved? We'll call! Once you're approved, we'll give you a quick call to confirm details and do a final credit check.

- Money on its way: After the call, it usually takes about 2 hours to send the funds to your dealer.

Our goal is same-day approval, but it can vary depending on any extra info needed.

We want to get you behind the wheel of your new car as soon as possible!

Is HP finance hard to get?

HP car finance is a good option for many people, but getting approved depends on a few factors:

- Credit score: A good credit score can help, but it's not the only factor.

- Affordability: Lenders will assess your income and expenses to make sure the monthly payments fit your budget comfortably.

- Budgeting for the car: Having a realistic budget for the car (including down payment and ongoing costs) demonstrates responsible financial planning.

Here's the good news:

- Marsh Finance works with people who have less-than-perfect credit. We understand that financial situations can vary.

- Applying is easy and won't hurt your credit score yet. It only takes 30 seconds to apply online and get a pre-approval decision.

Ready to see if HP finance is right for you? Click here to explore your options !

Can you get HP with poor credit?

Don't let a less-than-perfect credit score hold you back! At Marsh Finance, we understand that credit scores aren't always ideal. Here's the good news:

- We consider more than just credit score: We take a more comprehensive look at your financial situation, including income and affordability.

- We offer HP finance options for various credit scores. Apply today and see if you qualify!

Here are some additional points to consider:

- Improve your chances: While we can help, a higher credit score can lead to better interest rates.

- Apply with no impact: Our pre-approval process is quick and won't hurt your credit score yet.

See if you're pre-approved for car finance here, with no impact on your credit score.

Do I own my car at the end of my HP agreement?

Yes! Once you've made all your HP car finance repayments, the car becomes yours. You'll be the legal owner and free to do any of the following:

- Keep it and enjoy your ride!

- Sell it privately or to a dealership.

- Trade it in as a down payment on a new car.

- Use it as collateral for another loan (subject to approval).

Upon full payment, you'll receive a "statement of title" from Marsh Finance or the lender. This document is official proof that you own the car.

Is hire purchase a good idea?

HP finance can be a good option if:

- You want to own the car: At the end of the HP agreement, once you've made all the repayments, the car is yours.

- You don't have a big down payment: HP lets you spread the cost of the car over time without a large upfront sum.

- Mileage limits aren't a concern: Unlike PCP, HP doesn't typically have mileage restrictions.

Here are some other things to consider:

- Overall cost: HP can sometimes be more expensive than PCP because you're financing the entire car's value.

- Interest rates: The interest rate you qualify for can affect your overall cost.

What are the pros of hire purchase?

- Affordable way to finance a car.

- Flexible repayment options that can be tailored to your budget and needs.

- Low initial deposit can help make the car more accessible.

- Fixed interest rates provide stability and predictability for budgeting.

- Ownership of the car at the end of the agreement.

- No mileage or usage restrictions as you own the car during the agreement.

- Can help build credit history and improve credit score through regular repayments.

What are the cons of hire purchase?

- If you miss payments, your credit score can be negatively affected, and the car can be repossessed.

- You’re tied to the car for the duration of the agreement and may have to pay early settlement fees if you want to end it early.

- You don’t own the car until you’ve made all the repayments, so you’re unable to sell the vehicle until you’ve paid off your agreement.

- No large balloon payment at the end of your agreement, as there would be with a PCP agreement.

- Not suitable for short-term car ownership or if you plan to change your car frequently.

-1.png?width=360&name=Thinking%20(2)-1.png)

.jpg?width=360&name=HP%20Hero%20Image%20Option%20(2).jpg) A happy woman at a car dealership showing her car keys to the camera with a red convertible in the background." width="1920" height="1080" />

A happy woman at a car dealership showing her car keys to the camera with a red convertible in the background." width="1920" height="1080" />